Code changes, Revenue Rulings, Treasury pronouncements, judicial decisions, state law, federal law, legislative wranglings, tax policy, tax treaties, audits and examinations, politics and which way the wind blows may each have a direct impact on you, your tax situation and your financial welfare. How can you be expected to keep up?!

Not to worry! It is my job to gather pertinent news and disseminate it for you in bite-size and digestible chunks. For that purpose, I have created this blog in which I will frequently and informally list information relating to tax matters. Articles will be published as discrete entries or "posts" and displayed in reverse chronological order so that the most recent post appears first.

Not to worry! It is my job to gather pertinent news and disseminate it for you in bite-size and digestible chunks. For that purpose, I have created this blog in which I will frequently and informally list information relating to tax matters. Articles will be published as discrete entries or "posts" and displayed in reverse chronological order so that the most recent post appears first.

Please check back often to stay abreast of tax issues that may pertain to you.

January 8, 2024: Tax Season Opening

The IRS has just announced that it will begin accepting and processing 2023 tax returns on Monday, January 29th, 2024.

TopDecember 20, 2023: Penalty Forgiveness

The IRS has announced that it will waive penalty fees for taxpayers who owe less than $100,000 in back taxes for the years 2020 and 2021. The decision to forgive the failure-to-pay penalties is attributed to the temporary suspension of automated reminders during the pandemic; however, the IRS now plans to resume sending collection notices. Taxpayers who meet the eligibility criteria will automatically receive the relief without needing to take additional action. Those who have already paid the failure-to-pay penalty will receive a refund.

TopNovember 13, 2023: What the Prez paid

Based on their TY’22 tax returns as released by the White House, President Joe Biden and First Lady Jill Biden paid $137,658 in federal income taxes on $579,514 in earnings, yielding an effective tax rate of 23.8% that was compatible to that of the prior year. In TY’21, the Bidens reported earnings of $610,702 and paid federal taxes of $150,439, equivalent to an effective tax rate 24.6%.

By comparison, Vice President Kamala Harris and her husband Douglas Emhoff reported $456,918 in adjusted gross income in TY’22, a fraction of the $1.7 million reported in TY’21. They paid $93,570 in federal income tax, for an effective federal rate of 20.5%.

TopJune 17, 2023: Not all IRS Notices are the same

The IRS recently apologized for issuing CP14 Letters to California taxpayers eligible for 2023 disaster-related postponements and stated that these communications good be ignored [see Blog entry dated 6/8/23]. But the same is not true for late-filing or late-payment notices even if the taxpayer qualifies for disaster-postponement relief. Instead, recipients of these notices should contact the tax authority immediately to request abatement of any assessed penalty. NOTE: CP14 Letters are balance due invoices that are generated automatically whenever a scheduled due date has passed to inform taxpayers that they have 21 days to pay. Late-filing or late-payment notices, on the other hand, are issued on a case-by-case basis and must be addressed on an individualized basis.

TopJune 8, 2023: IRS Penalty Notices Issued in Error

In tweets released late yesterday, the IRS stated that California taxpayers who qualify for the disaster-related October 16th postponements (August 15th for Modoc and Shasta counties) still have until the October 16th (August 15th) postponement deadlines to pay their 2022 tax liabilities. The IRS stated that taxpayers receiving erroneous CP14 letters do not need to call the IRS or their tax professionals. The tax authority acknowledged that the CP14s are automatically generated when taxpayers have a balance due, but that taxpayers eligible for the disaster postponements do not have any balances currently due. The IRS apologized to taxpayers and tax professionals for any confusion.”

TopMarch 20, 2023: Deductible Medical Expenses

The IRS has just posted FAQs to help taxpayers determine whether certain costs related to nutrition, wellness and general health are medical expenses that may be paid or reimbursed under an HSA, FSA, Archer MSA or other health reimbursement arrangement. The FAQs explain that an eligible expense must be for the treatment of a diagnosed disease or illness (like programs for substance abuse, alcohol use disorders, or smoking cessation). Some expenses may only be deductible if they're prescribed by a doctor to treat a specific disease. For example, a gym membership purchased as a result of a diagnosis for obesity or high blood pressure would be deductible, while a membership bought for the individual's general health would not be.

TopMarch 9, 2023: Bad Advice

With AI and ChatGPT headlining so many stories, TaxBuzz decided to take the technology for a test drive by asking, “What [filing] status I should use when filing my taxes?” In response, ChatGPT very helpfully provided the definitions of all filing options and then said, “You can consult a tax professional to help determine the best option for you.” That’s probably a good idea!

TaxBuzz posed additional questions, seeking advice on various real-world scenarios, and discovered that the software providedincorrect answers in every case! It seems that ChatGPT often started out on the right track but then missed important nuances in – not to mention updates to – the tax code. In fact, the software developer admits that ChatGPT’s current version is only trained on data sets available through 2021. It should also be noted that expertly trained humans have access to trusted and verified libraries of information that can be used to verify tax strategy claims. ChatGPT simply doesn’t have the same level of brainpower or education.

TopMarch 2, 2023: Storm Relief (CA conforms)

California has just announced that it will conform to the IRS’s postponement of filing and payment deadlines to October 16, 2023, for taxpayers located in all California counties except the Imperial, Kern, Lassen, Modoc, Plumas, Shasta, and Sierra. This applies to all returns and estimated taxes due prior to the October 16th deadline, as well as payroll tax returns but not employment and excise tax deposits.

TopMarch 1, 2023: FBAR Penalty (SCOTUS rules)

With a narrow margin, the Supreme Court sided with the taxpayer, a dual citizen who did not file Foreign Bank Account Reports (FBAR) for 5 years while living in Romania. As per the Bank Secrecy Act (BSA), US citizens and residents are required to report their foreign holdings to the US Treasury each year. The BSA authorizes penalties of as much as $10,000 for unintentional failures to file. The issue at hand was whether that penalty should be assessed on a per-form or per-account basis. The IRS concluded that Mr. Bittner violated the law 272 times, once for every account that was not reported in each of 5 years. The taxpayer, on the other hand, believed that he had violated the law only 5 times, once for each annual report he had failed to file. The Court agreed and held that “the BSA treats the failure to file a legally compliant report as one violation carrying a maximum penalty of $10,000, not a cascade of such penalties calculated on a per-account basis.”

However, the Court was careful to emphasize the difference in the statutory language that applies to willful (rather than non-willful) violations: “Because Congress explicitly authorized per-account penalties for some willful violations, the government asks us to infer that Congress meant to do so for analogous non-willful violations as well. But, in truth, this line of reasoning cuts against the government. When Congress includes particular language in one section of a statute but omits it from a neighbor, we normally understand that difference in language to convey a difference in meaning.”

TopFebruary 25, 2023: CA Storm Relief EXTENDED

As Southern California braced for blizzard – including in the mountains outside Los Angeles – for the first time since 1989 and much of the rest of the state endured catastrophic flooding, mud- and landslides, the IRS announced that it would further extend the tax filing deadline for taxpayers affected by the winter storms. Previously postponed to May 15th, the deadline was pushed yet farther to October 16th. Taxpayers throughout California may now delay filing income tax returns that were originally due on April 18th, along with different business returns normally due on March 15th or April 18th and returns of tax-exempt organizations typically due May 15th. Additionally, eligible taxpayers may postpone 2022 contributions to their IRAs and health savings accounts until October 16th. Since the IRS automatically provides filing and penalty relief to any taxpayer with an IRS address of record located in the disaster area, extension requests need not be filed.

But since CA’s tax authority has not (yet?) announced that it will conform to the federal extension and because not all of CA’s 58 counties are covered under the federal relief order, I urge all taxpayers to submit an extension request regardless. Submitting Form 4868 for individual filings and comparable forms for business filings is a simple and routine task that may ensure that those taxpayers who mistakenly believe that they’ve qualified for disaster relief are in fact protected from a potential late filing penalty. And because an extension merely extends the time for filing not payment, taxpayers ineligible for federal (or state) disaster relief should submit payments on or before April 18th sufficient to cover any outstanding liability that may result when the TY’22 returns are eventually prepared.

TopFebruary 11, 2023: State Relief Payments

The wait is over. The IRS has decided that it will not tax the special payments made by 21 states in 2022. As a result, affected taxpayers will not have to report these payments – including California’s Middle Class Tax Refund – on their federal returns. The IRS did not specifically state that these payments are excludable disaster relief payments or that they qualify for the general welfare exclusion. Instead, the tax authority determined that it would be “in the interest of sound tax administration” not to challenge a taxpayer’s position if he chose to exclude these payments from gross income. A state-by-state list of eligible payments is available on the IRS website.

TopFebruary 8, 2023: Wait!

The IRS has asked taxpayers who received special tax refunds or payments from some states during 2022 to delay filing their returns until the tax authority has determined whether such refunds/payments are federally taxable. The warning applies mostly to taxpayers in California, which offered a Middle-Class Tax Refund last year to millions of residents. Other states may be affected as well, including Colorado, Delaware, Georgia, Hawaii, Idaho, Illinois, Maine, New Mexico, South Carolina, and Virginia, which sent rebates to taxpayers after they reported budget surpluses. The IRS advises that “the best course of action is to wait for additional clarification on state payments rather than calling the IRS. We also do not recommend amending a previously filed 2022 return."

TopJanuary 13, 2023: And so it begins...

The IRS will begin accepting and processing TY’22 returns on January 23rd. IRS Free File opens today, allowing participating providers to accept (but not yet submit) completed returns. Many commercial tax preparation software companies and tax professionals will also accept returns prior to January 23rd but must wait to submit these returns until the IRS systems open.

The tax authority has projected that more than 168 million individual returns will be filed, most before the April 18th filing deadline. NOTE: This year’s filing date falls on the 18th since the 15th falls on a Saturday and is automatically deferred to Monday. However, Monday is Emancipation Day, which commemorates the abolition of slavery and is deemed a holiday for federal tax-filing purposes. California, as well as many other – but not all – states have conformed to the April 18th deadline. An outdated list if filing deadlines in 2022 is available here – the list for 2023 has not yet been published.

TopJanuary 10, 2023: CA Storm Relief

The IRS has just announced that California storm victims have until May 15, 2023 to file various federal income tax returns and make any tax payments that would otherwise have been due between January 8th and April 18th of the current year. Relief is offered to any area designated by the Federal Emergency Management Agency (FEMA), which includes individuals and households that reside or have a business in Colusa, El Dorado, Glenn, Humboldt, Los Angeles, Marin, Mariposa, Mendocino, Merced, Monterey, Napa, Orange, Placer, Riverside, Sacramento, San Bernardino, San Diego, San Joaquin, San Luis Obispo, San Mateo, Santa Barbara, Santa Clara, Santa Cruz, Solano, Sonoma, Stanislaus, Sutter, Tehama, Ventura, Yolo and Yuba counties qualify for tax relief. Other areas added later to the disaster area will also qualify for the same relief. An updated list of eligible localities is available on the IRS’ Disaster Relief page.

Additional relief for eligible taxpayers includes deferral of (1) IRA and HSA contributions for TY’22 until May 15th; (2) 4th quarter estimated tax payments that would be due January 17th may instead be submitted with the 2022 filed on or before May 15th; and (3) quarterly payroll and excise tax returns normally due on January 31st and April 30th. NOTE: Penalties on payroll and excise tax deposits due on or after January 8th and before January 23rd will be abated if the tax deposits are made by January 23rd.

Relief is granted automatically to any taxpayer with an IRS address of record located in the disaster area. Therefore, taxpayers do not need to contact the agency to get this relief. However, if an affected taxpayer receives a late filing or late payment penalty notice from the IRS that has an original or extended filing, payment or deposit due date falling within the postponement period, the taxpayer should call the number on the notice to have the penalty abated. The IRS will also work with any taxpayer who lives outside the disaster area but whose substantiating records are within the affected area. Taxpayers qualifying for relief who live outside the disaster area should contact the IRS at (866) 562-5227.

TopJanuary 6, 2023: Audit Stats (2022)

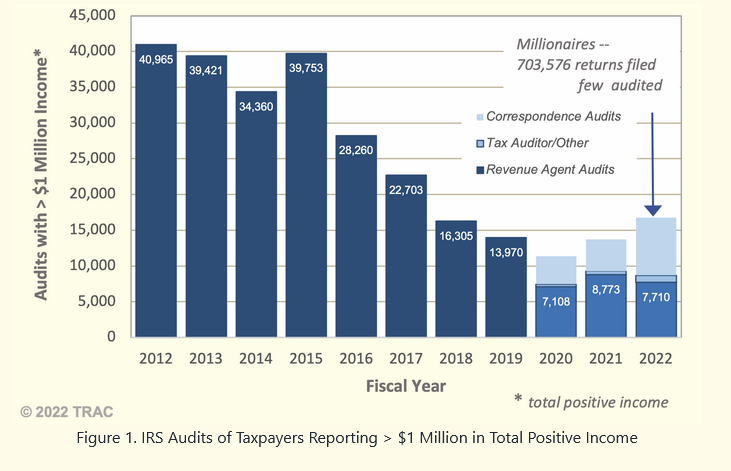

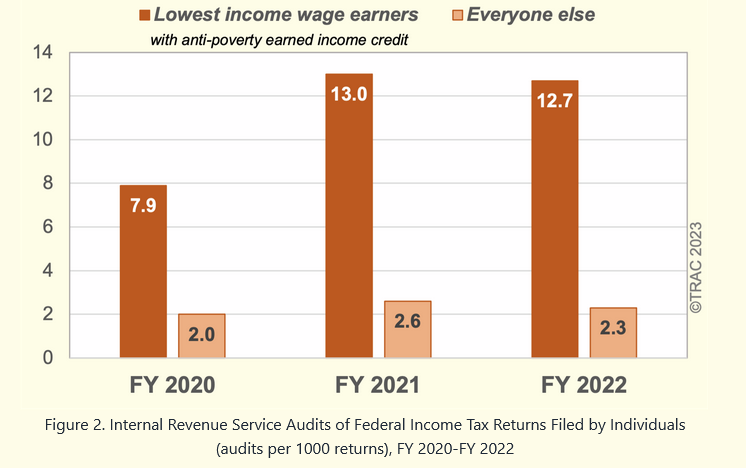

In its study, Syracuse University found that the IRS audited 626,204 returns (out of more than 164 million individual income tax returns filed in 2022), roughly 33K or 5% less than in the prior year. Syracuse found that the IRS relied more on correspondence audits, with about 85% of audits conducted through the mail. Together, the odds of being audited was just above 1/3 of 1%. In 2021, “the odds of audit had been 4.1 out of every 1,000 returns filed (0.41%)." While the odds of millionaires receiving some attention by the IRS rose to 2.8%, about 700,000 millionaires received no scrutiny whatsoever. In fact, fewer millionaires were subjected to a regular (non-correspondence) audit than the lowest-income wage-earners (1.1 versus 1.27%).

Top

Top

November 21, 2022: IRS stats released

The Department of the Treasury has just released its 417-page summary report about individual income tax returns for 2020 [that’s not a typo]. Some of its most salient facts include:

- Taxpayers filed 164.4 million individual income tax returns in TY’20, 4.2% more than in TY’19.

- Adjusted gross income (AGI) rose by 5.2%. Roughly 1/3 of this increase was attributable to net capital gains.

- Wage income increased by only 1.7% to $8.4 trillion. Unemployment compensation jumped to $405 billion in the first pandemic year, up from $21.4 billion in 2019.

- Taxable income grew by 6.3% to $9.8 trillion.

- The average federal income tax rate in 2020 was 12.6%, up from 12.3% in 2019.

- Taxpayers earning from $2 – 10 million paid the highest average rate (28%), although the wealthiest taxpayers who earned more than $10 million enjoyed a lesser average rate (25.5%); most likely because the bulk of their income was in the form of long-term capital gains, which are subject to lower rates.

October 11, 2022: Smishing

It’s a thing!

It’s phishing via text message. More accurately, smishing is a cyber-security attack carried out over mobile text apps rather than e-mail. Smishing text messages often purport to be from your bank, asking you for personal or financial information such as your account or ATM number. Attackers hope that you’ll open a URL link within the text message that will lead you to a website or app that poses under a false identity. The smishing scheme is successful once the cyber-criminal has gained access to your private information enabling him to steal funds from a bank account, commit identity fraud to illegally obtain a credit card, or leak private data to the highest bidder.

The IRS warns that smishing attacks now also attempt to gather data by sending out fake text messages, known as lures, that offer COVID relief, tax credits, and even help setting up an online account with the tax authority. As before, the IRS reminds taxpayers that it does not send e-mails or texts asking for personal or financial information. If you receive such a message, the IRS asks that you forward the scammer’s text message to 7726 (SPAM).

TopAugust 26, 2022: Tax Insurance

It’s not so much “tax” insurance – since we already know that we will be taxed – as it is audit coverage. In the event a policy holder’s tax position on a return is successfully challenged by the IRS, the insurer will typically cover any additional tax owed, as well as interest and penalties. The policy may also cover legal and accounting fees incurred in defending a challenge and pay a gross-up to cover the tax due that will be owed when the insurance proceeds are paid out. Paul Caron, Dean of the Pepperdine Caruso School of Law, reports that the IRS will receive a nearly $80 billion funding boost under the newly enacted Inflation Reduction Act, with nearly $46 billion earmarked for enforcement. As a result, the IRS will not only have the budget to increase the number of audits it performs but also be able to litigate more of the tax positions it reviews.

Tax insurance policies, which usually have policy terms between 7 – 10 years, are only written on tax positions that are strong and supportable and are not meant to cover instances of known wrongdoing. While there were less than a handful of insurers 4 or 5 years ago, there are about 20 insurers that offer such policies today as demand for coverage becomes ever more popular. Roughly 6,000 policies were placed in 2021, compared to 500 policies written in 2015.

TopJune 9, 2022: Updated Mileage Rates

For the first time since 2011, the IRS has instituted a mid-year raise to the applicable mileage rates. Effective on July 1st, taxpayers may now claim the following amounts [in cents/mile]:

| Rates 1/1 thru 6/30/22 | Rates 7/1 thru 12/31/22 | |

| Business | 58.5 | 62.5 |

| Medical/Moving | 18 | 22 |

| Charitable | 14 | 14 |

IRS Commissioner Chuck Rettig stated that the adjustment is intended to reflect the “recent increase in fuel prices.”

TopMay 16, 2022: Biometric Data

While the IRS previously promised to eliminate its online authentication program with ID.me, it seems that the tax authority will continue to work with the third-party authenticator after all despite strongly voiced concerns regarding poor customer service, sign-up difficulties, and undesired direct marketing solicitations. The IRS now offers taxpayers two methods to sign up for an online account that allows access to individual account information including balance, payments, tax records and more: Taxpayers may either provide biometric data (as before) or verify their identity during a live, virtual interview with agents.

The Office of the Taxpayer Advocate has stated that “prior biometric data stored, including files that were already collected from customers who previously created an IRS Online Account, will be permanently deleted by March 11, 2022.” Taxpayers who nevertheless remain concerned about the possible misuse of personal information may – as per ID.me – opt out from receiving marketing e-mails, delete selfie image and other biometric data, or close their account.

TopApril 18, 2022: Tax the rich!

As the tax season draws to its close today, it seems that 40 million Californians owe a debt of gratitude to its fellow citizens. Well, at least to a very small percentage of fellow compatriots: One-half of 1% of the state’s population. These are the 96,322 taxpayers with Adjusted Gross Income (AGI) in excess of $1 million. In the aggregate, they reported $300 billion of taxable income (equal to an average of $3.1 million per taxpayer) and collectively paid $35.3 billion into the state’s coffers (or an average of $366K per taxpayer). High-income taxpayers contributed 39% of CA’s total individual tax collections. NOTE: The combined income of these elite taxpayers totaled 9% of CA’s wage and salary earnings, 42% of taxable interest income, and 45% of dividend income, reflecting “how investments, not paychecks, drive the income of the most wealthy” as per the LA Times.

Narrowing the focus and examining only the 10,344 wealthiest Californians who earned at least $5 million, the data show that these taxpayers owed $19 billion in state taxes (equal to 21% of total collections). In contrast, the state Franchise Tax Board (FTB) reports that three-quarters of all returns are filed by taxpayers with an AGI under $100K, and that half of all returns are filed by taxpayers with AGI less than $50K! These statistics not only prove that there is an enormous divide between the have and have-nots in CA , but also refute the oft-quoted misconception that the rich don’t pay tax.

TopMarch 18, 2022: Crypto Currency Question

The IRS reminds taxpayers that there is a virtual currency question at the top of the federal Form 1040 that asks, “At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency?” All taxpayers must answer either “Yes” or “No.”

Taxpayers may check “No” if they have not engaged in any transactions involving virtual currency during the year; they merely held virtual currency in their own wallet or account or transferred virtual currency between their own wallets or accounts; or purchased virtual currency using real currency. In most other circumstances, taxpayers must check “Yes.”

The most common transactions in virtual currency that require checking the “Yes” box, include:

- Receipt of virtual currency as payment for goods or services provided;

- Receipt or transfer of virtual currency for free that does not qualify as a bona fide gift;

- Receipt of new virtual currency as a result of mining and staking activities;

- Receipt of virtual currency as a result of a hard fork;

- Exchange of virtual currency for property, goods, or services;

- Exchange of virtual currency for another virtual currency;

- Sale of virtual currency; and

- Any other disposition of a financial interest in virtual currency. NOTE: If a taxpayer disposed of a virtual currency that was held as a capital asset through a sale, exchange, or transfer, the taxpayer is required to check “Yes” and use Form 8949 to figure the amount of capital gain or loss to be reported on Schedule D.

If a taxpayer received virtual currency as compensation for services or disposed of any virtual currency held for sale to customers in a trade or business, the taxpayer must report the income in the same manner as if wages or business income had been received in fiat currency (e.g., US dollars).

TopMarch 4, 2022: No tank tax!

While I presume Ukrainian citizens are currently focused on defense and survival rather than tax matters, the Ukrainian National Agency for the Protection against Corruption has nevertheless issued this helpful proclamation:

Have you captured a Russian tank or armored personnel carrier and are worried about how to declare it? Keep calm and continue to defend the Motherland! There is no need to declare the captured Russian tanks and other equipment.

Apparently, it is assumed that any enemy equipment obtained will likely be destroyed or disabled and will, therefore, be worth less that the government-decreed de minimis amount of 248,100 Ukrainian hryvnia [equivalent to roughly 8,000 USD].

WARNING: While Ukrainian citizens may not be taxed on the spoils of war, US citizens do not enjoy a similar exemption. Recall that US citizens are taxed worldwide income from whatever source derived [IRC §61(a)], whether obtained legally or not [Commissioner v. Glenshaw Glass Co., 348 U.S. 426]. The US Supreme Court held that gross income exists when there are “instances of undeniable accessions to wealth, clearly realized, and over which the taxpayers have complete dominion.” Commandeering an enemy tank surely grants the procurer such dominion, which therefore requires recognition of taxable income on Form 1040, Schedule 1, Line 8z (Other Income).

TopFebruary 15, 2022: IRS Update Page

The Internal Revenue Service has set up a dedicated webpage to provide the latest information about the current tax season and the agency’s efforts to deal with the backlog of millions of previously filed returns. The IRS hopes to raise taxpayer awareness and provide the timely information for filing TY’21 returns as well as information for those still waiting for prior-year returns to be processed.

TopFebruary 8, 2022: Identity Verification for MyFTB

California’s Franchise Tax Board (FTB) just announced that it hascompleted its Real-time Identify and Proofing Enrollment process allowing for expedited access to MyFTB online accounts. Taxpayers may now register for MyFTB without waiting for a Personal Identification Number (PIN) letter to be sent by mail. Instead, MyFTB accounts can be activated with verification by answering personal questions that have been compiled by TransUnion, a third-party credit agency. Taxpayers unable to obtain TransUnion verification, will continue to receive their PIN letters in the mail. NOTE: Business representatives creating a MyFTB account to access entity accounts will not have the option for instant access and will continue to receive PIN letters in the mail.

TopFebruary 7, 2022: No ID.me!

The IRS announced it will transition away from using a third-party service for facial recognition to help authenticate people creating new online accounts. The transition will occur over the coming weeks in order to prevent larger disruptions to taxpayers during filing season. During the transition, the IRS will develop an authentication process that does not involve facial recognition while continuing to work with its cross-government partners to develop authentication methods that protect taxpayer data and ensure broad access to online tools. NOTE: The transition announced today does not interfere with the taxpayer's ability to file current returns or pay taxes owed.

TopJanuary 24, 2022: Advanced Child Tax Credit Letters

WARNING: IRS Letters 6419 sent to taxpayers summarizing amounts of Advance Child Tax Credit payments received during 2021 may report inaccurate amounts! Amounts may be confirmed by requesting an IRS transcript, going to the Child Tax Credit Update Portal, or verifying a taxpayer’s bank deposits.

TopJanuary 21, 2022: Facial Recognition

Starting this summer, the IRS will require taxpayers who wish to access their accounts and pay their taxes online to enroll with a third-party facial recognition company. Even those who have already registered on IRS.gov with a username and password will have to provide a government ID, a copy of a utility bill, and a selfie to ID.me, the Virginia-based identity verification company. Unfortunately, The Verge reports that the current sign-up process is “time-consuming and glitchy.”

Although ID.me claims that it doesn’t sell, lead, or trade biometric data to any third parties, it can share information with its partners with users’ explicit permission and requires registrants to accept its biometric consent policy. And the company may retain your biometric data for several years, even if you delete your ID.me account!

TopJanuary 14, 2022: IRS Backlog

National Taxpayer Advocate Erin Collins released her Annual Report to Congress, calling 2021 “the most challenging year taxpayers and tax professionals have ever experienced.” She stated that the “imbalance between the IRS’ workload and its resources has never been greater.” While individual filings increased by 19%, IRS staffing decreased by 17%. As a result, the IRS has a backlog of 6 million unprocessed individual returns (Forms 1040), 2.3 million unprocessed amended returns (Forms 1040-X), more than 2 million unprocessed quarterly payroll tax returns (Forms 941 and 941-X), and about 5 million pieces of unanswered taxpayer correspondence. Some submissions date back to last April (!) and many taxpayers are still waiting for refunds 9 months after filing

TopJanuary 13, 2022: CA Mortgage Relief Program

California’s new program will pay up to $80K of mortgage, property tax and insurance bills for qualified applicants. To qualify, a household must earn no more than the median income in its area (e.g., $118,200 for a family of four in Los Angeles County), and the home at risk of foreclosure must be the household’s primary residence. The program is designed to aid only those homeowners who are already well behind on their mortgages on account of the pandemic and are not in the process of working out a repayment plan with their lenders. Folks who have received other forms of government assistance or a previous loan forbearance from their lender are still eligible to apply. And aid will be available for qualifying people with reverse mortgages. However, assistance is only available to borrowers with mortgages offered by lenders who have elected to participate in CA’s program. To date, the state estimates that lenders servicing roughly 83% of eligible loans are already participating and has reached out to the remaining servicers in an attempt to get them to sign up as well.

Additional information and applications are available online or by calling (800) 569-4287. The program will remain available on a first-come-first-served basis to homeowners who became delinquent in 2020 or 2021 until its $1 billion budget is depleted. CA estimates that it will be able to assist 20 – 40K borrowers.

TopJanuary 12, 2022: Back-door ROTH Conversions

Under current law, if your modified adjusted gross income exceeds $140K (Single) or $208K (married) you cannot contribute directly to a Roth IRA. But you can still put money into a ROTH by using a loophole dubbed “the backdoor strategy” by converting after-tax contributions to a non-deductible Traditional IRA. The proposed Build Back Better (BBB) bill seeks to prohibit taxpayers of all income levels from converting after-tax savings into a Roth IRA, thereby preventing high-income earners from contributing to ROTHs. Of course, the BBB has not yet become law. Nevertheless, taxpayers should remain vigilant since the provision may be enacted in its previously proposed (or another) form with an effective date that is (as yet) uncertain. CAVEAT: While unlikely, the provision may even be enacted retroactively to year-start.

TopJanuary 11, 2022: Info Letters for 2021 Payments Received

The IRS will be mailing notices to affected taxpayers who received Advance Child Credit and/or Economic Impact Payments during 2021. These letters are intended to help taxpayers to reconcile payments actually received and correctly calculate credits to which they may be entitled when filing their 2021 tax returns. Do not throw these letters away; be sure to provide them to your tax practitioner along with all other data.

TopJanuary 10, 2022: The Tax Filing Season Begins

The IRS has announced that it will begin processing business tax returns on January 7th and individual returns on January 24th, 2022. Although the IRS Free File program will open January 14th, participating providers must hold all prepared returns until they can be filed electronically on the 24th. NOTE: Since Emancipation Day falls on April 15th in the current year, the federal tax filing deadline is automatically extended until Monday, April 18th. Due to the Patriot’s Day holiday celebrated in Maine and Massachusetts, the federal filing deadline in those two states is postponed until April 19th. Most, but not all states conform to the federal filing deadlines for state filings – be sure to check the applicable dates in your state. The FTB has conformed; as a result, the filing deadline for California personal returns is April 18th, 2022.

TopSeptember 27, 2021: Closing Letter Fee

Beginning October 26th, the IRS will charge a $67 user fee to issue a closing letter. Courtesy letters were once issued to any estate that filed Form 706, verifying that the IRS had satisfactorily completed its review of the estate tax return. In recent years, fiduciaries were advised to obtain a free IRS account transcript in lieu of the closing letter. Today’s announcement finalizes the tax authority’s transition from paper to online reporting but provides certain executors with the ability to request a written letter for a fee.

TopSeptember 23, 2021: Private Collection Agencies

The IRS has awarded new contracts to three private-sector collection agencies for the collection of overdue tax debts. Starting today, taxpayers with unpaid tax bills may be contacted by one of the following three agencies: (1) CBE Group, Inc. (800) 910-5837; (2) Coast Professional, Inc. (888) 928-0510; or (3) ConServe (844) 853-4875. REMINDER: The Private Debt Collection program was established under federal law in 2016, allowing designated private contractors to collect certain unpaid tax debts on the government’s behalf.

TopSeptember 15, 2021: Address Change

In a few short days, the return processing center in Fresno will permanently close. Originally scheduled for 2016, this closure is part of a larger, ongoing efficiency strategy. Since more than 90% of all returns are now submitted electronically, processing of paper returns will no longer be done at the central California campus. Instead, taxpayers located in Alaska, California, Hawaii, Ohio, and Washington are asked to mail returns to this address:

Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201

April 9, 2021: Excess Premium Tax Credit

In yet another retroactive change mandated by the American Rescue Plan Act of 2021, taxpayers do not have to repay excess Advance Premium Tax Credits (APTC) received when they purchased healthcare coverage through the Marketplace.

When applying for insurance, taxpayers must provide an estimate of annual income. Out-of-pocket insurance premiums and subsidies (in the form APTC) are then computed based on this earnings estimate. Form 8962 must later be filed with the tax return to reconcile the APTC computed during the application process with the Premium Tax Credit (PTC) that is computed when preparing the return. Excess credits (if any) must be repaid by increasing the tax liability (or reducing the tax refund). It is this repayment that has been forgiven for TY’20 only.

But because many taxpayers have already filed tax returns prior to today’s announcement, IRS guidance states that affected taxpayers do not need to file an amended return or contact the tax authority. Instead, the IRS will reduce the excess APTC repayment amount to zero and will reimburse people who have already repaid any excess amounts on their 2020 tax return. Taxpayers who received a letter about a missing Form 8962 should disregard the letter if they have excess APTC for 2020. The IRS will process tax returns without Form 8962 for tax year 2020 by reducing the excess advance premium tax credit repayment amount to zero.

TopApril 8, 2021: Recovery Rebate Letters

Taxpayers who have filed their TY’20 returns may receive follow-up correspondence from the IRS to correct a Recovery Rebate Credit (RRC) that was improperly claimed on the federal return. As a reminder, the first and second Economic Impact Payments (EIPs) were advance payments received during 2020 and early 2021, respectively. The amounts received – while not taxable – were required to be reconciled on the TY’20 return. If the taxpayer correctly reported the EIPs, no further adjustment would be required. However, if taxpayers reported incorrect amounts of EIP – too much or too little – or didn’t report any amount received, the IRS will make any necessary corrections, adjust the tax liability accordingly, and issue a letter of explanation.

The IRS determines the eligibility and amount of the taxpayer's RRC based on the TY’20 tax return information and any amounts of EIPs previously issued. In some instances, the RRC will be reduced by the amount of any EIPs already issued to the individual. In other cases, the IRS will increase the RRC if the taxpayer was entitled to but did not previously receive the EIPs. The IRS will calculate the proper RRC amount, make the correction, and continue processing the return. Slight processing delays may occur. Taxpayers may obtain additional information on a special Q & A page which explains what errors may have occurred. Taxpayers who disagree with the IRS calculation should review their letter as well as the questions and answers for what information they should have available when contacting the IRS.

TopApril 5, 2021: FBAR Penalties

Failure to file a Foreign Bank Account Report (FBAR) as mandated by the Bank Secrecy Act of 1970 can be costly. US persons are required to file an FBAR if the aggregate maximum value of all foreign accounts exceeds $10K at any time during a calendar year. The penalty for non-willful failure to file is $10K [adjusted annually for inflation, the penalty in 2021 is $12,921]. The statute, however, is not clear whether the penalty should be applied an a per-form or per-account basis. Historically, the Treasury has stacked the penalties by assessing taxpayers for each account that was not properly reported. In the recently decided case of Giraldi [Civil Action No. 20-2830 (SDW) (LDW) (D.N.J. Mar. 16, 2021)], the court held in favor of the taxpayer, reasoning that non-willful penalties assessed on a per-account basis could irrationally exceed willful violation penalties which are legislatively limited to the greater of $100K or 50% of the unreported account balance(s). For example, if two individuals each maintained $100K in 20 foreign accounts; a non-willful violator could be penalized up to $200K (= $10K/ account x 20 accounts) while the willful violator would be penalized only $100K.

TWO CAVEATS: (1) The distinction between willful and non-willful failure to file is a legal determination based on the taxpayer’s “willful blindness” to and “reckless violation” of FBAR requirements [Technical Advice Memorandum 2018-013]. (2) Giraldi was decided in District Court in the 3rd Circuit and is not binding on the IRS in all cases.

TopMarch 27, 2021: Masks & PPE

The IRS has just clarified that the purchase of personal protective equipment (e.g., masks, hand sanitizer and sanitizing wipes) for the primary purpose of preventing the spread of COVID are deductible medical expenses. Medical expenses are deductible if itemized on Schedule A and if the aggregate of all medical costs exceeds 7.5% of Adjusted Gross Income (AGI).

Taxpayers have the choice to itemize or claim the Standard Deduction. Due to the tax code change in 2018 which dramatically raised the Standard Deduction, most taxpayers no longer itemize. As a result, today’s announcement is of little consequence. It should, however, be noted that amounts paid for personal protective equipment are also eligible to be paid or reimbursed under health flexible spending arrangements (health FSAs), Archer medical savings accounts (Archer MSAs), health reimbursement arrangements (HRAs), or health savings accounts (HSAs).

TopMarch 26, 2021: EIP Debit Cards

Stimulus payments will arrive by direct deposit if taxpayers have previously provided bank information to the IRS.. If the info is unavailable, the IRS will instead mail a paper check or a debit card.

Some taxpayers, unaware of the IRS policy and concerned that they may have received a fraudulent card, may inadvertently discard the debit card. Not to worry! Taxpayers who had not activated their cards by February 1st, will receive a letter from the IRS reminding them to activate their card or request a replacement by calling (800) 240-8100.

TopMarch 25, 2021: State Filing Deadlines in 2021

The IRS has announced that the federal income tax filing deadline for individuals for the 2021 tax season will be postponed from April 15th to May 17th, 2021. States, however, are not always in compliance with federal guidelines. To monitor this situation, the National Society of Accountants (NSA) has created a State Tax Updates Page with the latest deadline changes and will update the page as new information becomes available.

TopFebruary 28, 2021: Lifetime Tax Outlay

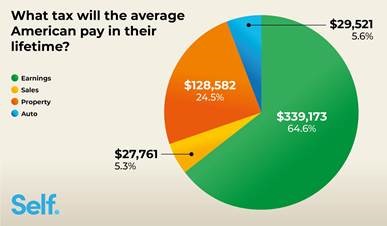

According to a recent analysis of Bureau of Labor statistics published by CPA Practice Advisor, the average American will pay $525,037 in taxes throughout his lifetime. This sum equates to an average of roughly 34% of all lifetime earnings; ranging from a low of 24.48% in Alabama to 49.51% in New Jersey. California and New York are in 4th and 6th highest place, respectively, at about 44% of lifetime earnings. Taxes aggregated in this study included income tax, as well as vehicular, property and sales tax.

February 4, 2021: Fraudulent unemployment claims

Some taxpayers may soon receive Form 1099-G reporting unemployment insurance (UI) or pandemic unemployment assistance (PUA) benefits they have never received, indicating that they are likely victims of a fraud scheme newly rampant in the COVID era. California taxpayers are asked to report suspected fraud to the Employment Development Department (EDD) online or by calling (866) 401-2849. Once the fraud has been reported, the EDD will investigate the case as identity theft and will, when the investigation is completed, issue a corrected 1099-G. The EDD has not indicated how long this might take. REMINDER: Although California does not tax UI or PUA benefits, the IRS does. Reporting zero benefits or a lower amount than that reported on the 1099-G will delay the processing of the federal return.

TopFebruary 2, 2021: Beware of crypto enforcement

The IRS’ criminal investigation division warns that while the agency has until now focused its resources on informing the public of proper reporting guidelines for virtual currency transactions, it will now be turning to more stringent enforcement. The shift in focus is due in part to an ever-widening tax gap between calculated and actual tax liabilities, often the result of un- and/or under-reported crypto-currency transactions. To help ensure compliance, the IRS has placed a question prominently on page 1 of Form 1040 that asks taxpayers whether they have a financial interest in or have been involved in a any transaction with a virtual currency during the tax year.

TopJanuary 15, 2021: Late start

The IRS has just announced that the 2021 tax filing season for TY’20 returns will start on Friday, February 12th. Typically, the tax authority begins accepting and processing individual income tax returns in late January, but the IRS needed extra time this year to update and test its systems to reflect late-year tax changes approved by Congress, including a second round of economic stimulus payments.

TopDecember 1, 2020: One down and oh-so many to go

Forbes reports that Hitesh Patel has been sentenced to 20 years for his role in operating and funding call centers that defrauded US victims out of millions of dollars between 2013 and 2016. As part of the scheme, scammers utilized a network of call centers in India to call potential victims in the US. Using personally identifiable information obtained from a number of sources including social media, scammers impersonated agents from the IRS or US Citizenship and Immigration Services (USCIS) to demand that taxpayers pay fake tax bills immediately or face arrest, deportation or other legal action.

The US Treasury Inspector General for Tax Administration (TIGTA) referred to the con as "the largest scam of its kind that we have ever seen,” accounting for 1 of every 4 scams reported and topping the IRS’ Dirty Dozen scam list. Patel has since admitted that losses of loss of between $25 million and $65 million are attributable to him.

TopNovember 16, 2020: Life Expectancy

Despite the perils of COVID, it seems that we are living longer. As a result, the IRS has updated the tables used to compute required minimum distributions (RMD) from retirement plans for calendar years beginning January 1, 2022. Under these revised regulations, a 72-year old IRA owner who uses the Uniform Lifetime Table to compute his RMD may now base his withdrawal amounts on a life expectancy of 27.4 years, rather than 25.6. (That’s a 7% increase.) This means that retirees will be required to withdraw less from their retirement plans and – if the IRS is correct – live longer to enjoy retirement!

TopAugust 1, 2020: Signature or autograph?

While an autograph is in fact a “person’s handwritten signature” [Merriam-Webster], practical usage distinguishes such signature as one that is collectible. And indeed, that is precisely what 176 “lucky” taxpayers in Rhode Island may do! Excused as a mere technical glitch, the State Department of Revenue issued tax refund checks signed by none other than Mickey Mouse and Walt Disney. Upon realizing its mistake, the tax authority promptly voided the checks and promised to re-issue valid replacements (presumably properly signed by Seth Magaziner, Treasurer and Peter Keenan, State Controller). Recipients of the now invalidated checks now have what will indubitably become collector’s items.

While an autograph is in fact a “person’s handwritten signature” [Merriam-Webster], practical usage distinguishes such signature as one that is collectible. And indeed, that is precisely what 176 “lucky” taxpayers in Rhode Island may do! Excused as a mere technical glitch, the State Department of Revenue issued tax refund checks signed by none other than Mickey Mouse and Walt Disney. Upon realizing its mistake, the tax authority promptly voided the checks and promised to re-issue valid replacements (presumably properly signed by Seth Magaziner, Treasurer and Peter Keenan, State Controller). Recipients of the now invalidated checks now have what will indubitably become collector’s items.

Can the same be said for those COVID Stimulus checks that bear Donald Trump’s scrawl?

Like Mickey’s signature, a president’s signature on a government check is not only unprecedented but also has no legal significance since the president  is not an authorized signatory of checks issued by the Internal Revenue Service. It appears that President Nixon attempted to similarly politicize a government program when he demanded that his signature appear on Social Security checks. But for a determined government official, Nixon may have gotten his wish. Robert Ball joined what would become the Social Security Administration in 1939 and served as Commissioner from 1962 to until his retirement in 1973. An indefatigable champion of the program, he was known as “Mr. Social Security.” When Nixon sought to take credit for a benefit increase just prior to the 1972 election, Ball warned that the ploy would backfire and threatened to resign. In contrast, the LA Times writes that today the highest echelons of the federal government are occupied by Trump toadies who are willing to assuage Trump’s most childish demands.

is not an authorized signatory of checks issued by the Internal Revenue Service. It appears that President Nixon attempted to similarly politicize a government program when he demanded that his signature appear on Social Security checks. But for a determined government official, Nixon may have gotten his wish. Robert Ball joined what would become the Social Security Administration in 1939 and served as Commissioner from 1962 to until his retirement in 1973. An indefatigable champion of the program, he was known as “Mr. Social Security.” When Nixon sought to take credit for a benefit increase just prior to the 1972 election, Ball warned that the ploy would backfire and threatened to resign. In contrast, the LA Times writes that today the highest echelons of the federal government are occupied by Trump toadies who are willing to assuage Trump’s most childish demands.

Thus, COVID stimulus payments sent out by paper checks did in fact include Trump’s signature. But because recipients of these payments so desperately needed the funds to ease pandemic hardships, their checks have long been cashed. Trump’s signature, therefore, is just that: A signature not a collectible autograph.

TopApril 17, 2020: Resources

Stimulus Payments

Supplemental Security Income (SSI) and veterans will automatically receive Economic Impact Payments (EIP) without any further action.

Supplemental Security Income (SSI) and veterans will automatically receive Economic Impact Payments (EIP) without any further action.- Recipients who did not file TY’18 or TY’19 returns, with qualifying children under age 17 must register online with the IRS to receive the extra $500/dependent child payment.

- Recipients who previously filed either TY’18 or TY’19 returns may use the Get My Payment tool to check their payment status, confirm the payment type as direct deposit or check, and enter bank account information for direct deposit if the IRS has not yet sent the payment.

NOTE: Automatic COVID direct deposits will only be sent to taxpayers who received refunds in either TY’18 or TY’19. If returns were filed with tax liabilities due, recipients will instead receive paper checks in the mail since the IRS will not use bank account information that was provided at the time of filing to withdraw funds.

CARES Act

The July 15th extended deadline for filing and payment applies regardless of whether a taxpayer is actually sick or quarantined. The IRS has clarified that the COVID- extension also applies to FBAR filings, RMD rollovers, IRC §1031 exchange and first quarter payroll deadlines.

California

FTB’s FAQ page is updated continuously and offers info on a wide range of topics, including:

- Extension of time to file and pay taxes.

- Cancellation or rescheduling of electronic payments.

- Suspension of collection activities.

- Skipping installment agreement payments.

- Statute of limitations for claims, protests, appeals, and assessments.

- Free tax preparation options.

- How provisions of the Federal CARES Act apply to California.

Service Interruptions

- The IRS has temporarily discontinued 3rd party authorizations – do not fax requests for Centralized Authorization File (CAF) numbers until further notice.

- The Income Verification Express Service is also on hold – the online Get Transcript service is still available.

- The IRS is currently not processing paper returns, responding to paper correspondence or staffing toll-free live service lines.

April 4, 2020: CV tips for individuals

Recovery Rebate Credit (a.k.a. Stimulus Payments)

Provided in the form of federally issued checks, these payments are in fact tax credits that will be used to reduce the TY’20 tax liabilities of low- to moderate-income taxpayers. Rather than wait until the 2020 returns are filed in early 2021, the IRS will issue these rebates in advance to provide taxpayers with immediate relief and hopefully stimulate our CV-ravaged economy. Eligibility and credit amounts, therefore, will be provisionally based on information from returns already filed for TY’19 (or TY’18 if the 2019 return has not yet been filed). HEADS UP: There will be a reconciliation process when the TY’20 returns are eventually filed to provide additional benefits to taxpayers whose payments were improperly reduced or eliminated based on prior-year taxable income that was higher than actual current-year income. Conversely, failure to properly reduce the credit on a TY’20 return will be treated as a mathematical error, subject to immediate assessment. However, it does not appear at this time that taxpayers will have to repay excess credits received.

The IRS expects that the first wave of checks will be automatically deposited into the same bank account reflected on a taxpayer’s 2018 or 2019 return beginning April 13, 2020. Paper checks will be mailed to taxpayers who did not provide direct deposit information on their returns beginning in May. Taxpayers who have already filed returns for TY’18 or TY’19 need not take any further action. Taxpayers who have not previously filed – whether delinquent or not required to file as per mandated filing thresholds – should immediately file to become eligible for the CV-relief payments. EXCEPTION: Social Security recipients who do not usually file will not be required to file returns at this time. Relief payments will be automatically deposited to their bank accounts beginning April 17th based on information provided on 2019 Forms SSA-1099 or RRB-1099.

Stimulus checks for dependents ($500) will be sent out to parents only if the dependent child is under age 17 at the end of 2020. FILING TIP: Taxpayers may want to forego claiming the dependent child as well as the $500 Child Tax Credit on the parental return, so that “child” may instead file an individual return to become eligible for his own $1,200 CV-19 relief check.

The Treasury expects to deliver 5 million checks weekly in the next 20 weeks (through the end of 2020). Taxpayers with the lowest incomes will receive their checks first. PHASE OUT: Taxpayers with incomes in excess of $75K (Single), $112.5K (HOH) and $150K (MFJ) will receive reduced benefits. No benefits will be paid to taxpayers with incomes exceeding $99K (Single), $136.5 (HOH) and $198K (MFJ).

GOOD NEWS: The stimulus payment is not taxable.

Miscellaneous Tax Provisions

Employer-paid sick and family leave benefits mandated by the Families First Coronavirus Response Act (FFCRA) are treated as taxable wages to recipient employees. RELIEF: Employers, however, may defer the payment of their share of Social Security taxes (6.2%) on these benefits. Medicare taxes (1.45%) may not be similarly deferred.

Reversing previously enacted TCJA changes, taxpayers may now carry-back 2018 – 2020 losses for up to 5 years. Losses from 2019 and 2020 may be used to offset 100% of taxable income.

Retirement-related Provisions

CV-affected taxpayers under age 59½ may withdraw up to $100K from retirement accounts – including IRAs and employer plans – without incurring the usual early withdrawal penalty. The withdrawn amount may be re-contributed to the account within 3 years, without being subject to the usual annual contribution caps. If not re-deposited, the withdrawn amounts will be included ratably as taxable ordinary income over a 3-year period.

Required Minimum Distributions (RMDs) have been waived for 2020. ALSO SUSPENDED: 2019 RMDs that had previously been properly deferred to April 1, 2020.

Administrative Issues

The IRS has announced that the Practitioner Priority Service Line, the e-Services Help Desk and the e-Services FIRE and AIR System Help Desks are closed until further notice. SUGGESTION: IRS online services such as Where’s My Refund and Get Transcript remain available.

The IRS has announced that it will accept e-mailed and digital signatures on documents related to the determination or collection of a tax liability. APPLICABLE TO: Extensions of the statute of limitations for assessment and collection, waivers of statutory notices of deficiency, closing agreements, and any other statements or forms needing the signature of a taxpayer traditionally collected by IRS personnel outside of the standard filing procedures.

MISC DEADLINES: The date for filing Gift Tax returns (Form 709) has been extended to July 15th as per IRS Notice 2020-20. California’s CDTFA has extended the due date for Q1 Sales and Use Tax filings and payments to July 31, 2020. Real property taxes have not been canceled or extended under federal relief legislation and should be timely submitted to local authorities. RELIEF: While each jurisdiction may apply differing rules, Los Angeles County plans to offer its residents the opportunity to submit an online request for penalty waiver due to CV-19 related delays.

TopMarch 29, 2020: CARES cures Connectivity!

For two weeks I’ve had no internet. It seems that my cable provider is unable to keep up with the demand of new stay-at-home schoolers, workers, gamers and Netflix watchers. Working offline for most of every day, I’ve had to set my alarm for midnight so that I can jump online to respond to e-mails, collect uploaded tax data, log on to tax and bookkeeping software that is inaccessible without an internet handshake and two-factor authorization, do time-sensitive research and e-file. Sleep has become a bit of a luxury in this COVID-era. BUT…

Only moments after the largest economic relief bill in US history passed, my internet access was restored! If coincidences count, I can only conclude that the legislation intended to offer direct payments to the majority of Americans, expand unemployment benefits and provide a $367 billion program for small businesses almost instantaneously convinced everyone that they no longer needed to work from home. Computer use must have dropped to the point that I could access the internet during daylight hours. I was a happy camper for about 6 hours. And then my fellow home-stayers must have discovered that they now had time to vacuum, do laundry, bake bread [read about the worldwide shortage of yeast] and watch TV. Soon enough, power went out…

Six times in a 2-day period; once for nearly 26 hours!

The lights have since come on and while I have momentary WiFi, I’d like to provide a brief summary of the behemoth bail-out bill referred to as the Coronavirus Aid, Relief and Economic Security Act (CARES) signed into law on Friday, which provides financial aid equal to one-half of the entire $4 trillion annual federal budget! These are the most salient provisions of the 335-page bill:

- Payroll protection loans up to $10 million (may be forgiven to cover basic operating expenses without realization of Cancelation of Debt income).

- $50 billion to encourage companies to retain employees on payroll and cover 50% of workers’ paychecks up to $10,000.

- $600/week additional unemployment benefits for up to 4 months; benefits have now been extended to gig workers as well.

- $130 million cash infusion to hospitals (with an additional $45 billion available through FEMA).

- $500 billion of guaranteed, subsidized loans to larger industries, including airlines and hospitals.

Tax-specific provisions include:

- Tax credit rebates of up to $1,200/individual and $500/child (phased out to zero for Single taxpayers with AGI between $75 and $100K; $150K if MFJ and $112.5K if HOH). Stimulus checks will be sent to all who have already filed a TY’19 return or previously filed a TY’18 return. SUGGESTION: Non-filers – including students, people on public assistance or working people whose income was below the applicable filing threshold – may wish to file a 2018 or 2019 return to qualify for rebate check. NOTE: Undocumented workers who filed using a TIN are not eligible to receive a check.

- Deferral of employers’ payroll tax deposits; half deferred to 12/31/21 and half to 12/31/22.

- Reinstatement of Net Operating Loss (NOL) carrybacks for 2018 – 20 taxable years.

- Penalty-free withdrawals of tax retirement funds of up to $100K, with income recognized over a 3-year deferral period.

- A waiver of Required Minimum Distributions (RMDs) for TY’20.

- Increased charitable contribution limitations and a $300 deduction for cash contributions allowed for taxpayers not itemizing deductions.

- Federal (not private) student loan payments may be deferred without late fees and penalties until 9/30/20.

March 26, 2020: Humor is the best relief

Courtesy of the publishers at The Week:

Courtesy of the publishers at The Week:

As mentioned in yesterday’s blog entry, I suggested to readers to treat this tax season as any other with regards to the extensions proffered by federal and state tax authorities. Rather than rely upon an unaccustomed date (July 15th) that may be forgotten or overlooked, I recommend that taxpayers either file timely now or submit Form 4868 as they normally would to obtain an automatic extension until October 15th. A closer look at the COVID-19 relief reveals that numerous returns commonly filed by individual taxpayers are not covered by the emergency legislation. For example, Foreign Bank Account Reports (FBARs) and gift tax returns (Form 709) can only be extended past the April 15th deadline if an extension request is filed for the taxpayer’s income tax return (Form 1040). Like the missus talking to the cat [above], I would almost prefer if my clients knew nothing about that darn July 15th extension!

On the other hand, it’s nice to know that federal collection and enforcement activities have been temporarily relaxed:

- Payments due between April 1st and July 15th for taxpayers under existing installment agreements have been suspended.

- Pending Offers-in-Compromise (OIC) applications will have until July 15th to provide additional supporting documentation.

- Payments on existing OICs may be suspended until July 15th.

- Liens and levies will generally be suspended during the relief period.

- New field, office or correspondence audits will not be initiated at this time, although the tax service will continue to hear appeals by telephone.

- New certifications to the Dept. of State for taxpayers who are “seriously delinquent” will be suspended.

- New delinquent accounts will not be forwarded to private collection agencies.

March 25, 2020: IRS answers

The questions have piled on. The IRS has replied on its new FAQ page dedicated to filing and payment deadlines. Critical issues that have been addressed include:

- The COVID-19 extended deadline of July 15th is available for only certain types of returns and filers. Specifically excluded are fiscal-year taxpayers, partnership and S-Corp returns that were due March 15th, and non-profits which must file by May 15th.

- Relief is also not extended for payroll, excise, estate and gift taxes; nor are information returns covered.

- Most importantly, 2nd quarter estimated tax payments due June 15th must still be timely filed. [Yes, 1st quarter ES payments can be postponed to July 15th without penalty or interest accrual, but 2nd quarter payments are subject to their usual deadline and must, therefore, be paid sooner than the postponed ES #1 liabilities.]

BEWARE: This can become complex and confusing. And taxpayers may become forgetful. I, along with many practitioners, am suggesting that the conventional payment schedule be maintained to avoid unintended oversights. Keep in mind that the extension merely provides 90 days of relief during which unremitted funds will collect no interest in the bank.

AND: State tax authorities have independently offered COVID-19 relief, in some cases postponing the filing deadline, in others deferring payment deadlines but not necessarily offering consistency or conformity with federal guidelines!

SUGGESTION: Unless unduly affected and financially burdened by the pandemic, it’s best to stick with filing and customary payment deadlines.

BONUS: The IRS has clarified that the deadline for prior-year contributions to IRAs, employer retirement plans and health savings accounts has been extended from April 15th to July 15th. If you choose to take advantage of this extension, be sure to mark you calendar. It would be a pity to forget the contribution deadline and forgo the benefits of these tax-saving strategies.

TopMarch 24, 2020: State responses to COVID-19

The National Society of Accountants (NSA) has just published a concise summary of COVID-related extension deadlines adopted in each state. While the data is ever-changing and a few inaccuracies are already included [e.g., Hawaii has deferred its income tax filing deadline to July 20th], the list is nevertheless helpful if only to provide a reminder to taxpayers that states do not automatically conform to federal tax guidelines. Links to each state’s tax authority provided in the attached PDF offer taxpayers the opportunity to obtain the most up-to-date information directly from the proverbial horse’s mouth.

It appears that most states have indeed postponed filing and payment deadlines from April 15th to July 15th, although some have adopted alternative deadlines: Mississippi (5/15), New Jersey (6/30), South Carolina (6/1) and Virginia (6/1). Other states – including Delaware, Massachusetts, New Hampshire, New York, Ohio, Tennessee and West Virginia – have not (yet?) announced changes. Those states that do not impose individual income taxes, need not of course change filing deadlines: Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming.

Check the list. Check it twice! Contact the tax authority or me for most accurate information.

TopMarch 21, 2020: Some clarity

Families First Coronavirus Response Act (the Act): Since enactment two days ago, the IRS has clarified that small and mid-size employers may take immediate advantage of refundable payroll tax credits created to fully reimburse the employer for the cost of providing COVID-19 benefits to employees. As per News Release 2020-57, businesses may use payroll tax funds that they would otherwise be required to remit to the tax authority to pay employee benefits. While onerous trust fund penalties would normally apply when an employer misappropriates payroll tax funds, the Act provides for an exception under which employers may use some or all of the payroll tax deposits to provide sick leave benefits. In fact, if an employer pays more in benefits to his employees than he would otherwise be required to deposit with his payroll tax returns, he may file a request for an accelerated credit so that he can be made whole expeditiously.

Under the Act, employees may receive up to 80 hours of paid sick leave for absences related to COVID-19. Paid childcare leave benefits have been expanded if the employee’s children’s schools are closed or childcare providers are unavailable. Employers receive full reimbursement for these benefits in the form of a dollar-for-dollar offset against their payroll tax obligations. Employers with fewer than 50 employees are not required to offer these benefits if the viability if their business is threatened. A temporary moratorium on all enforcement actions for violations of the Act will be offered for a 30-day period, if the employer has acted reasonably and in good faith in his efforts to comply with the new legislation.

Extensions: The Treasury Secretary has announced that the April 15th filing deadline has been extended to July 15th. As a reminder, the tax authority had previously only extended the payment deadline. Now, taxpayers – including individuals, trusts, estates and business entities – may file their income tax returns as late as July 15th. While the IRS has not yet clarified, it is assumed that taxpayers who need additional time beyond July to file will have file a form to request an extension to October. IRS Notice 2020-18 clarifies that the extension applies only to income tax returns and income tax liabilities but does not address whether the extended deadline also applies to 2nd quarter estimated tax payments normally due on June 15th, IRA contributions, or payroll tax filings and payments.

Following suit, California extended its filing and payment deadlines to coincide with the federal mandate. Relief is offered to all taxpayers, in contrast to the federal relief that applies only to those “affected by the COVID-19 pandemic.”

Taxpayers who have already filed and arranged to have tax return and estimated tax liabilities automatically withdrawn by the tax authorities on the respective due dates, may contact the IRS at (888) 353-4537 and the FTB at (916) 845-0353 to cancel their pre-arranged payments at least 2 business days prior to the scheduled payment dates.

Closures: In response to several state directives to shutter all non-essential businesses, some IRS facilities have been forced to close, including Fresno and Philadelphia. Walk-in services at all locations have been temporarily halted and staffing has been reduced by about 50% at IRS campuses in Kansas City, Ogden and Austin. The US Tax Court has announced that it, too, has closed its building. Taxpayers must file all petitions by mail which will be held for delivery when the Court reopens. CAVEAT: Taxpayers must adhere to the rules for timely mailing evidenced by a US Postal Service postmark or a delivery certificate from a designated private delivery service.

TopMarch 20, 2020: More federal COVID-19 relief

The Families First Coronavirus Response Act was signed into law yesterday, mandating that small to mid-size employers must provide paid sick and/or family leave to each employee unable to work (or tele-commute). Employers who have provided such benefits to their employees may then claim an equivalent amount of refundable credit against their FICA taxes or self-employment tax.

While many questions remain about the implementation and specific provisions of the new legislation, a few things are clear:

- This mandate applies to employers (including government employers) with fewer than 500 employees.

- Employees are eligible for such payments if they are subject to a federal, state or local quarantine order, have been advised by a healthcare provider to self-quarantine, are experiencing symptoms of COVID-19, are caring for others, or must provide at-home care to child out of school.

It is still uncertain how the federal law will work in conjunction with the family leave program offered by the State of California.

On a separate and disturbing note: The governor of Pennsylvania has ordered all “non-life-sustaining” businesses within the state to close effective immediately. The National Society of Accountants understands that accounting, bookkeeping, tax preparation and payroll businesses are included in the order and may not continue physical operations.

TopMarch 19, 2020: Another COVID-19 Extension

In response to the IRS announcement that it would push back its payment deadline from April 15th to July 15th, California’s tax authority (FTB) has revised its previously announced deadlines [see March 15th blog entry below]. The FTB has now postponed the following filing and payment deadlines for individuals and businesses until July 15th:

- 2019 tax returns.

- 2019 tax return payments.

- 2020 1st and 2nd quarter estimated tax payments.

- 2020 LLC taxes and fees.

- 2020 non-wage withholding payments.

As with the federal deferral, California will not assess penalties or interest on deferred payments during this period but unlike the IRS, the FTB’s COVID-19 relief applies not only to payments but also to filing. Relief is extended to all California taxpayers, who need not claim any special treatment or call the FTB to qualify.

Nevertheless, the FTB recommends that taxpayers file as soon as possible, if only to obtain refunds to which they may be entitled sooner. As a practitioner, I have advised my clients to comply with long-standing filing and payment deadlines if at all possible. The proffered relief may be of tremendous benefit to some, but for others it merely provides an excuse to procrastinate. Many folks are currently (in)voluntarily committed to momentary inactivity and could use this down-time to clear their desks of the onerous chore of gathering tax data and completing the filing process in a timely manner by April 15th. Life will eventually and inevitably return to its norm and when it does, we might find ourselves overwhelmed with previously common-place tasks of getting kids off to school, commuting to work, resuming interrupted activities, shopping, and re-acquainting ourselves with friends and family; hardly the time we would then wish to use to comply with an IRS or FTB extension deadline!

TopMarch 18, 2020: COVID-19 Update

Yesterday, the IRS made its eagerly anticipated announcement that it would extend deadlines. The proclamation was followed by an onslaught of misinterpretation, confusion and misreporting as I received minute by minute updates from reputable media sources as well as professional tax associations. Here’s what we know now:

The IRS has extended the deadline for payments but did not extend the deadline for filing returns. That deadline to submit income tax returns remains – as before – April 15th. Payments, however, that would otherwise be due on April 15th may now be postponed up to 90 days on amounts up to $1 million. Corporate tax filers may delay payments on amounts up to $10 million. Postponed payments will not be assessed penalties or interest during the 3-month deferral period.

To be clear, the IRS expects taxpayers to adhere to the usual filing deadline. Should that not be possible for any reason – whether or not related to COVID-19 – taxpayers must file Form 4868 to request an automatic extension to October 15th (as in all years). The IRS has provided a coronavirus link on its website to provide guidance and useful resources to taxpayers during these turbulent times.

We next await the possible enactment of the Families First Coronavirus Response Act which would grant sick and family leave coverage to individuals working for small and mid-sized businesses. Paid sick leave will likely apply to anyone who must quarantine or is attempting to obtain preventative care. Additional clarification is, of course, needed and will hopefully be forthcoming if the bill is passed. Meanwhile, Congress ponders additional relief provisions that may include a payroll tax moratorium, payroll tax relief for independent contractors and workers in the gig economy, a return of Net Operating Loss (NOL) carrybacks, even a one-time payment of $1,000 to all adults. Check back for updates…

TopMarch 16, 2020: Signs of Tax ID Theft

Although the IRS proudly attributes the decline of tax-related identity theft to improved security measures, the tax authority also cautions taxpayers that they must be watchful. To help individuals recognize early signs of theft, the IRS has provided the following checklist of fraud indicators:

- An e-filed return is rejected because a return with the same Social Security Number has already been filed.

- A taxpayer receives a notice that income reported on the tax return is less than income reported on a W-2 or 1099.

- A taxpayer who has not yet filed a return receives authentication letters (5071C, 4883C or 5747C) asking for confirmation of his identity.

- A taxpayer who has not yet filed a return receives a refund check in the mail.

- A taxpayer receives a tax transcript he did not request.

- A taxpayer who created an Online Services account receives a notice that the account was accessed or disabled.

- A taxpayer who did not create an Online Services account is told that an account has been established in his name.

Vigilance is key! And to help unsuspecting taxpayers, the IRS is now required to notify potential victims if unauthorized use of an individual’s identity may have occurred. And the IRS must ensure that the victim of tax id fraud will not be subject to any penalty for underreporting income resulting from the unauthorized use of his identity.

TopMarch 15, 2020: COVID-19 extensions

California has just announced that taxpayers affected by the coronavirus have been granted an extension to file 2019 returns and make certain payments until June 15th, 2020. This relief includes moving the various tax filing and payment deadlines that occur between March 15th and June 15th, including:

- Partnerships and LLCs taxed as partnerships now have a 90-day extension to file and pay by June 15th.

- Individual filers now have a 60-day extension to file and pay by June 15th.

- Quarterly estimated tax payments normally due April 15th are now due June 15th.

The FTB advises taxpayers to write “COVID-19” in black ink atop the tax return to alert the tax authority of the special extension period. The FTB will waive interest and any late filing or late payment penalties that would otherwise apply.

BEWARE: The IRS has not yet followed suit and currently advises that “taxpayers should continue to file and submit tax returns as they normally would." For the moment, the deadline for filing an individual federal income tax return remains April 15th, 2020.If more time is needed, an extension must be filed.

Other states have taken independent action that ranges from office closures to deadline extensions. It is best to check with the individual tax authorities directly. Contact information and web-links are available on the State Info page of this website.

TopFebruary 27, 2020: The benefits of using Direct Deposit